2022 Fundraising

RDB relies entirely on donations and sponsorships for funding. Please consider us – as a local charity we do not have access to the resources of larger charities and rely on donations from individuals and local businesses. We also appreciate those who support us by taking part in events and raising sponsorship money for our cause.

In the last couple of years especially, RDB has had to adapt and thrive in order to ensure we continue to support our beneficiaries.

RDB needs to continue to help its groups and individual clients during these difficult times, and we need to raise the funds to do so.

Your support will ensure we can continue to have a huge positive impact on the physical and mental wellbeing of our disabled riders, volunteers and their carers and families in the Western Algarve (Barlavento).

We aim to:

- Recover from COVID-19;

- Continue to empower our disabled riders, families and volunteers

- Respond to our communities needs and ensure their health and wellbeing

- Renovate our outside spaces

- Take our riders to Special Olympics Qualifiers

Every donation counts:

- €10 can contribute to purchasing new equipment or materials needed to run the charity

- €20 can help towards the horses’ upkeep or pay for volunteer training

- £100 could help towards the cost of maintenance of the outside spaces and the cost of a new shed, creating a warm and dry space for riders and drivers, as ours is close to collapse!

Our outside space is in desperate need of renovation

Thank you in advance for your donation that will make a difference and ensure the future of the RDB community.

We now have various ways to make a donation to make it simpler, quicker and less painful!

Click on the headings below to see more information about each donation method:

Our IBAN is:

PT50 0045 7194 4023 1017 4812 9

If you require a receipt please contact us to notify us of the donation and supply your full name, fiscal number and the amount of the donation.

No institution can function without associates!

Become a RDB associate for the small minimum payment of €12 per year and be first to hear about all our planned events and activities.

Please fill in our registration form.

We have set up a super simple & speedy way to donate – whether a one-off or monthly, donations can now be made in just a couple of clicks.

Simply choose the amount you wish to donate, ensure you are under the correct tab (one-off or monthly) and click the button.

You will be taken through to a Stripe payment page where you enter your card details and submit. Just a couple of minutes of your time can make a difference!

Check out the options below

Pop up to Quinta Paraíso Alto on a Monday, Wednesday or Friday morning with some good old-fashioned cash!

If you are a PT tax payer you can support us very quickly & easily through your IRS. You can support social solidarity institutions like RDB without spending a single cent.

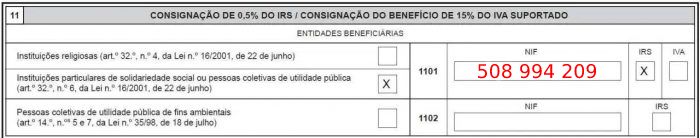

The state allows 0.5% of your paid IRS to be turned into a donation to a public benefit institution, such as RDB. Just indicate our NIPC 508 994 209, in Field 1101, Table 11, Model 3.

A good reason to show solidarity via your IRS is that here you don’t lose money or pay more for it, since the IRS consignment allows you to divert 0.5% of your tax, which would go into the state coffers (and not 0.5% of what is returned to the taxpayer), to a solidarity entity chosen by the taxpayer.

Let’s imagine that you have 4,000 euros of tax paid to the State, instead of this amount going in its entirety in tax, you will end up donating 20 euros (4000 x 0.5 = 20) of that amount to RDB. It may seem like very little, but the truth is that with these small grains we achieve much more. If every tax payer in the Western Algarve were to nominate RDB on their tax returns it could add up to a very helpful amount.

If you use an accountant to submit your tax return remember to ask them to do this for you, all it takes 5 seconds and does not cost you anything.

VAT deduction

In addition to donating 0.5% of the IRS, the taxable person can contribute with the deduction of 15% of the VAT paid, selecting with an “X” the spaces “IRS” and “IVA” in the aforementioned table. However, it should be noted that in this second case there are already costs for the taxpayer, the money not being diverted from the State as in the consignment, but removed from its possible VAT deduction in the IRS receivable. We know that it represents a much greater effort, but for us it represents a lot.

Donations

In addition to showing solidarity via your IRS, it is possible to show solidarity during the year with donations. Donations are tax deductible with the IRS.

Leaving a bequest to RDB is a wonderful way to help ensure that these vital services to the community can continue in future years.

Our riding programmes help improve disabled riders’ quality of life and provide them with the therapy, skills and freedom that they deserve.

The biggest gift of your life could be to simply include RDB in your will. Thank you for considering us.

Here is a list of key information for you:

- Choosing your bequest

- The proper wording to use in your will

- Wherever the need is greatest

- Our Fiscal Number

What kind of cause do you want to support?

Do you want to choose a charity who supports children and adults? A charity who works with disabled people? A charity who helps with health? A charity that helps with education? An animal charity? A charity that has many volunteers?

Riding for the Disabled Barlavento can help you to achieve all of the above.

By choosing to leave a gift in your will for RDB, you will be making an impact into the future.

What is a good charity to make a bequest to? Only you can decide, but if you want to help riders get great, positive outcomes you can do this by leaving a gift in your will.

Making a Will

Every adult should have a valid and current will. Many adults either do not have a will, or their will may be out of date. If you die without a valid will, legislation decides how your estate is to be distributed.

A will shows that you care about those you love. Making a will can give you peace of mind, knowing that your wishes for family, friends and community organisations important to you, have been identified and addressed.

You may choose to leave specific items to particular beneficiaries, or you may choose to share your entire estate on a percentage basis. You may choose Riding for the Disabled Barlavento as a beneficiary in your will.

Your will is a legal document, and it is best that you have it prepared by a lawyer so that it is worded and signed correctly. This ensures your estate will be able to be distributed in accordance with your wishes.

In Portugal, the personal law is the law of the nationality of the individual, so if you already have a will it is not essential to register a new one in Portugal if you have moved here. However, if you have assets and bank accounts in Portugal it is recommended to also make a Portuguese will which will allow to your heirs to access the assets they inherit. Under Portuguese law, if you do not have a Will and die resident in Portugal, all your assets will be distributed by the “forced heirs”.

For further information please consult with a solicitor.

Bequests and Your Interests

Many people like to leave a gift to charity, and Riding for the Disabled Barlavento is a wonderful charity to give a bequest to because we are a charity who helps so many children and adults.

Whether you want to leave a bequest for children, a bequest for disabled people, a bequest for health, a bequest for education, or a bequest for sport and recreation, you will know that Riding for the Disabled Barlavento helps in all these areas.

Leaving a Bequest

Bequest giving is a simple and effective way of continuing your support for your favourite charity or if you want to make a real investment in the charity’s vital services into the future.

Choosing your bequest

The choices for your bequest can be any of the following.

- A euro value

- A percentage of your estate

- A residual gift, meaning you can leave the balance of your estate. This is the option that we prefer.

The proper wording to use

The proper wording to use for a gift in your will is set out below.

I give to the Riding for the Disabled Barlavento Association the sum of €xx OR xx percentage of my estate OR the residue of my estate OR description of property or assets for its general purposes OR for the specific purpose of [insert here].

And I declare that a receipt appearing to be given by the Chief Executive Officer or an authorised officer of Riding for the Disabled Barlavento Association shall be a full and sufficient discharge to my trustees.

Wherever the need is greatest

If you are happy that your gift is used wherever the need is greatest, this will be the most use to us. You can achieve this by choosing “for its general purposes“.

Charity Number

The fiscal number for Riding for the Disabled Barlavento is 508 994 209.

The impact of your bequest

A bequest is a wonderful way to support RDB beyond your lifetime. A bequest has no effect on your financial situation now, and will mean so much to the people we care for.

Talking to us

If you are considering making a bequest or would like to talk about what is involved and how this can help the work of RDB, then please contact us.

You can become a sponsor and we will work in partnership with you to meet your goals for marketing and sales.

Whether you are looking to demonstrate corporate social responsibility, to encourage corporate volunteering, or to show you care, we will work with you to assist you to meet your objectives.

If you would like to be a corporate supporter, you may wish to let your staff know about payroll giving, fundraising opportunities and volunteer days. Please direct them to this page.

If you are a business, a trust, or an individual, and you would like to discuss sponsorship, we welcome having a discussion with you.

Please contact us to start talking about how we can help you with your goals.

Short of time? Donate a one-off or recurring fixed amount online in minutes

"When I am on a horse I am walking again"

- Eugênio Tweet